Marshall Data Reveals Generations as Best Customers

Customers shopping today may differ significantly from those who visited in the past. They could be younger with higher incomes or perhaps newcomers to the area. Therefore, it’s essential for retailers to consistently assess the profiles of their current buyers and the shoppers entering the market to ensure they are on the right track. This evaluation might reveal that the retailer is perfectly aligned with customer needs and should continue their current strategy. Conversely, it may indicate that adjustments are necessary to attract active customers.

The following example demonstrates how a furniture store can analyze its past performance and future direction using Marshall data. The key questions for this type of audit include:

- “Where will you shop FIRST for furniture?”

- “In the past two years, where did you make your last furniture purchase?”

- “In the next 12 months, do you plan to buy furniture?”

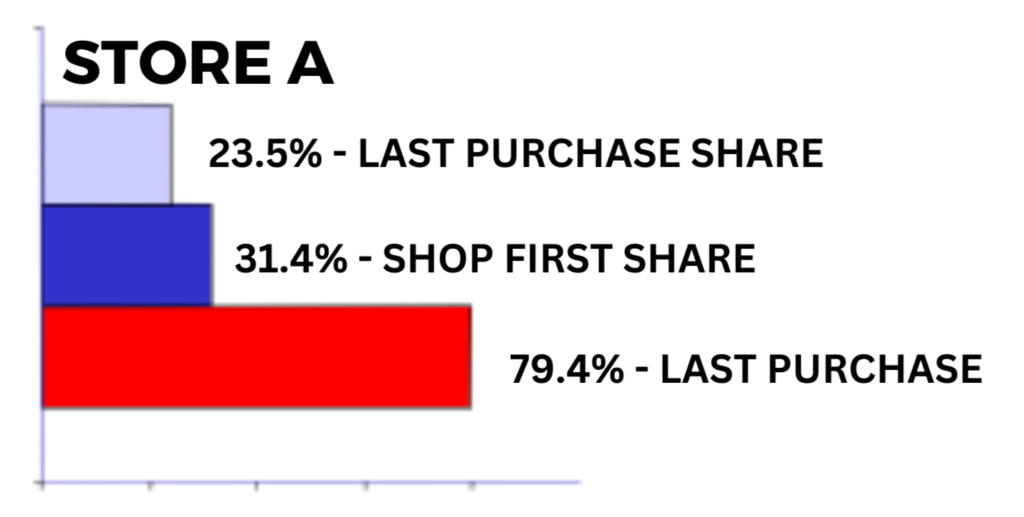

Store A is the leader in this market. It is a mid range furniture store that caters to several customer segments. It’s Last Purchase share of 23.5% nearly doubles that of its closest competitor. Also, it is the leader in Shop First share among customers planning to buy furniture. Finally, 79.4% of customers that made their last purchase at Store A would shop Store A First for their next purchase. This is all very impressive.

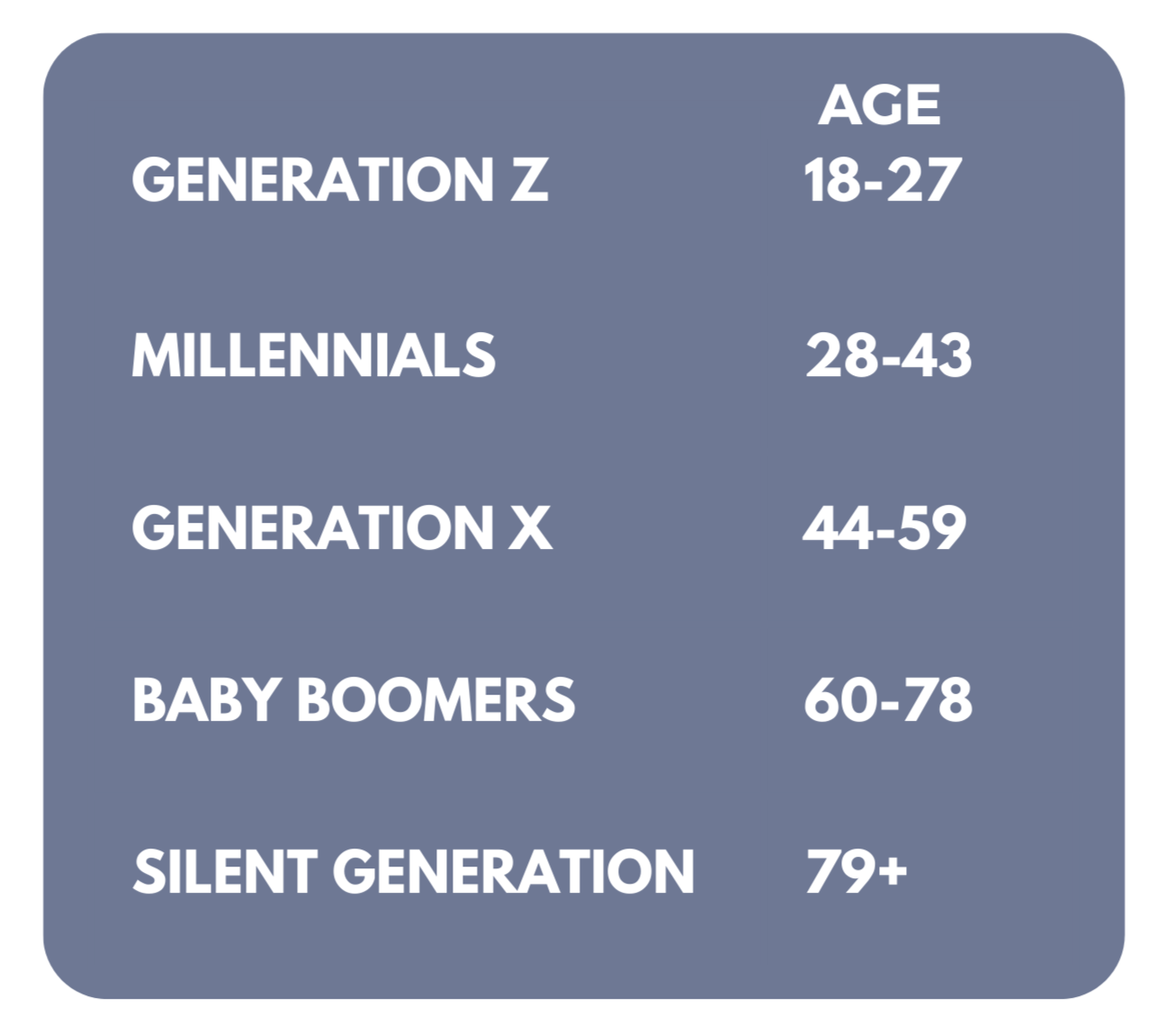

Examining the demographic profile of Store A’s customers reveals a tendency towards higher income levels, particularly among Baby Boomers. In contrast, those planning to purchase furniture within the next 12 months also exhibit a higher income but are generally younger than Store A’s existing customer base. Store A is well-positioned to attract these potential buyers, as the profile of furniture shoppers who prefer to shop at Store A shows a high income index among Generation X. However, there is a noticeable weakness in appealing to Millennials and Gen Z, as this group may not have the income to be a viable target for Store A.

So, where does the opportunity lie? Store A’s media mix includes the largest portion of dollars going to direct mail, then linear TV. Millennials and Gen Z furniture buyers index very low as readers of direct mail, but they’re extremely high users of digital media. Store A could build awareness and shop share by adjusting media to fit the buying profile. This also is a great opportunity for vendor/supplier dollars to reach a secondary target customer. Match a vendor/supplier to a target group of Millennials and Gen X. Then, build a schedule directly aimed at that target. Track results with your Marshall data to gauge impact on Shop First share.

IN CONCLUSION, integrating questions that uncover past consumer behaviors and future intentions allows you to develop profiles based on profitable demographic segments, such as generational cohorts. These profiles can then be cross-referenced with media, ultimately aiding you in crafting a robust strategy for your clients.

Download or Print a PDF version of this Story